Due to the fact that insurers make use of various aspects to cost rates, the most inexpensive insurance provider before an infraction most likely won't be the least expensive after - sr22 insurance. Our evaluation found that while Geico had the most inexpensive ordinary yearly rate for a great motorist with minimal insurance coverage, after a DUI the price boosted by greater than 150%, pushing the firm out of the leading five least expensive firms for an SR-22 in California.

For How Long Does SR-22 Last? This is a typical question that increases a great deal of concerns among high-risk drivers, yet it is necessary to note that it won't last Additional info permanently (insure). Just how long do you have to have an SR-22? It depends on your state, most require that you keep it for 3 years, but it can vary from one to 5. insurance companies.

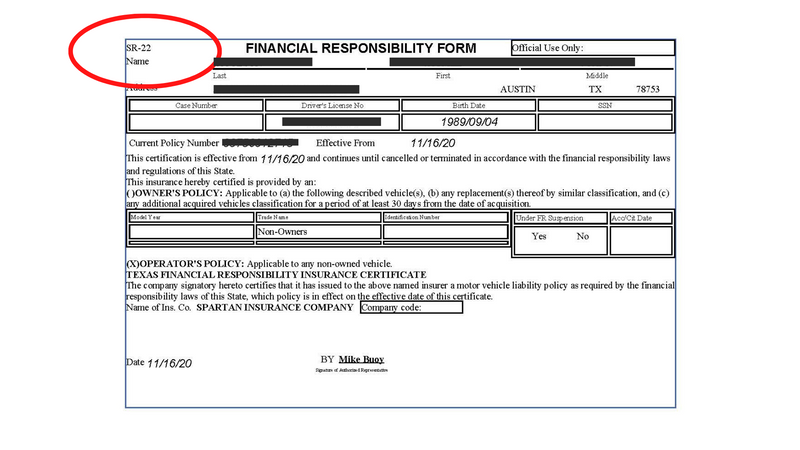

An SR-22 is a certificate of economic obligation needed for some vehicle drivers by their state or court order. An SR-22 is not an actual "type" of insurance policy, yet a kind filed with your state - deductibles.

Do I need an SR-22/ FR-44? Not everyone requires an SR-22/ FR-44. Rules differ from one state to another. Usually, it is needed by the court or mandated by the state just for particular driving-related violations. ignition interlock. : DUI sentences Careless driving Crashes caused by without insurance motorists If you require an SR-22/ FR-44, the courts or your state Motor Vehicle Department will certainly inform you.

Is there a cost linked with an SR-22/ FR-44? This is a single charge you should pay when we file the SR-22/ FR-44.

Unknown Facts About Faqs About Sr22 Insurance In Az

A filing cost is charged for every private SR-22/ FR-44 we submit. If your partner is on your policy and both of you require an SR-22/ FR-44, after that the filing cost will certainly be charged two times. Please note: The fee is not included in the price quote since the filing cost can differ.

Your SR-22/ FR-44 must be valid as long as your insurance coverage plan is energetic. If your insurance coverage plan is terminated while you're still needed to bring an SR-22/ FR-44, we are required to notify the proper state authorities. insurance.

Greet to Jerry, your new insurance coverage agent. We'll call your insurer, review your current strategy, then discover the protection that fits your requirements and also conserves you cash (department of motor vehicles).

insurance dui ignition interlock auto insurance underinsured

insurance dui ignition interlock auto insurance underinsured

liability insurance insurance group sr22 ignition interlock underinsured

liability insurance insurance group sr22 ignition interlock underinsured

The expense of SR-22 insurance policy is usually substantially more than the cost of conventional automobile insurance policies, as insurance holders with previous driving offenses are taken into consideration high-risk to guarantee. How do I get SR-22 insurance policy coverage in Wisconsin? To get SR-22 insurance policy protection in Wisconsin, you will require to collaborate with an auto insurer licensed to do organization in the state.

If you're submitting an SR-22 type as an under-18 chauffeur, let the insurer know the filing is in lieu of sponsorship, implying that you're using for coverage to drive under the age of 18 without a parent or guardian as a sponsor. When your insurance firm files the SR-22 type on your behalf, it will typically charge a flat fee in between $15 and also $50.

Unknown Facts About Financial Responsibility Filing (Sr22) Information - Wisconsin ...

car insurance sr-22 motor vehicle safety insurance insurance coverage

car insurance sr-22 motor vehicle safety insurance insurance coverage

motor vehicle safety deductibles sr22 department of motor vehicles car insurance

motor vehicle safety deductibles sr22 department of motor vehicles car insurance

Upon refining the SR-22 form, the DMV ought to send you a letter verifying proof of insurance policy protection and also that you are legally qualified to drive once more (division of motor vehicles). Just how long is SR-22 insurance protection required in Wisconsin?

To locate the least expensive price for SR-22 insurance coverage in Wisconsin, we recommend for SR-22 quotes from several insurers (sr22 insurance). Insurance policy firms analyze risk in different ways and charge various costs appropriately, so looking for multiple quotes is typically the most effective technique to locate affordable SR-22 insurance coverage. sr22 coverage. We also suggest asking about potential price cuts, as motorists are often qualified for expense decreases based upon their automobile kind, driving record, involvement in a protective driving program, being a great student and also much extra.

In Wisconsin, all motorists under age 18 are called for to have a sponsor to acquire a motorist's license or trainer's permit. Severe driving infractions such as DUIs or DWIs (driving while drunk or damaged), hit-and-runs or negligent driving can result in retraction or suspension of a chauffeur's permit, along with the need for an occupational certificate.